"Dr. Zoidberg - RIP Oppo" (thetomselleck)

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

10/14/2019 at 19:49 ē Filed to: costs of living

0

0

51

51

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

"Dr. Zoidberg - RIP Oppo" (thetomselleck)

10/14/2019 at 19:49 ē Filed to: costs of living |  0 0

|  51 51 |

You !!!error: Indecipherable SUB-paragraph formatting!!! , as it appears to have zero explanation for itís findings, and is just a click-grab slideshow format. However, it was picked up by the local news.

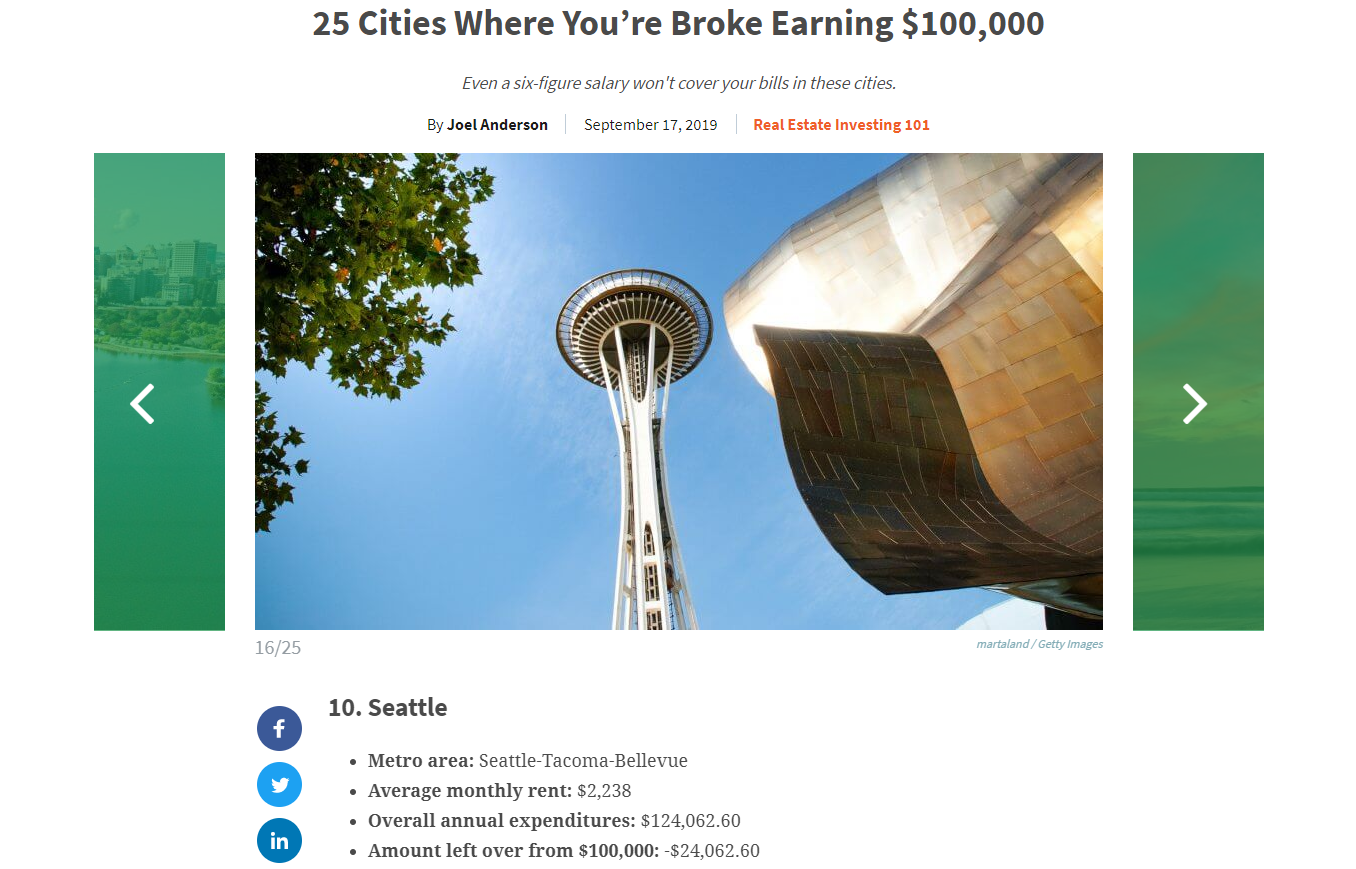

Premise is: if we plucked you from your life, stuck you to rent somewhere in Seattle, all alone , and paid you $100,000 a year to sit on the West Seattle Bridge, youíd be short of what you needed to make to live in Seattle by $24,062.60 (itís the sixty cents that adds legitimacy).

First, I was sad to think to myself, ď$2,238 for rent in Seattle alone? Thatís kind of cheap!Ē I once worked in a high-rise in Madison (and not the nice part) where new studios started at $3,000 a month... in 2015 .

Secondly, I immediately thought that $100,000 as a renter is probably more than sufficient. Am I wrong? Probably. Letís explore.

Income: $100,000

Disposable income: letís say $70,000

Minus annual rent: $43,144

Minus food for one person: $100/week (learn to cook!) -> $37,944

Minus water/refuse/internet/power: like... $400/month? -> $33,144

Two big wild cards are: transportation and student loans.

New high rises in downtown? Many of those people donít even own a car. That removes a car payment, gas, parking, registration, insurance, repairs, etc. Though cycling/buses/cabs are not cheap but I donít know how to quantify that. And who uses what will vary greatly.

And student loans... I know people who owe zero dollars; I know people who own over $50,000. Whether someone footed the bill for their higher education or not is a mystery on a person-by-person basis.

So letís say most people have at least one of either a car payment or a fat student loan payment (letís be honest: there must be some with both). Letís call it... $400 a month.

Iím not even going to speculate on credit card debt.

Minus misc. debt mentioned above: $28,344

So... you have $28,344 of disposable income leftover annually, before you buy a $7 dollar mocha every morning, go out drinking or use recreational drugs . Thatís $2,362.00 in hand, each month , after overhead (maybe) to do with what you will, with no dependents. That doesnít sound... terrible? Thatís some serious YOLO money.

Am I crazy? Help me out here.

MM54

> Dr. Zoidberg - RIP Oppo

MM54

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 19:57 |

|

You forgot the $45,000 uncle sam wants from that 100k

For Sweden

> Dr. Zoidberg - RIP Oppo

For Sweden

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 19:57 |

|

If you live in Seattle, you have to budget in a berth , maintenance , and fuel for your float plane .

CB

> Dr. Zoidberg - RIP Oppo

CB

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 19:59 |

|

Iím pretty sure everybody is bad with money. Financing isnít taught in school afterall. I guess everyone is blowing their money on... I donít even know.

If someone would like to give me $100k to live in Seattle for a year to find out, Iím onboard.

jimz

> Dr. Zoidberg - RIP Oppo

jimz

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 20:00 |

|

Help me out he re.

sure. donít live in a place where frickiní

rent

is $2400/month. And if you insist on living there, donít bitch about it. Where I live my rent is just a bit more than a third of that and itís a fairly big place.

Dr. Zoidberg - RIP Oppo

> MM54

Dr. Zoidberg - RIP Oppo

> MM54

10/14/2019 at 20:01 |

|

Uh, but I went from 100k to 70k in the first move based on typical income taxes, deductions for employer benefits

Dr. Zoidberg - RIP Oppo

> jimz

Dr. Zoidberg - RIP Oppo

> jimz

10/14/2019 at 20:03 |

|

Based on your reply, I will assume you read only the first and last sentence of my post.

just-a-scratch

> Dr. Zoidberg - RIP Oppo

just-a-scratch

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 20:07 |

|

You are not crazy, though your description of disposable income doesnít seem right to me. Perhaps that was meant to be income after taxes, though 30% income tax is pretty high now. M aybe just use 24% ?

Dr. Zoidberg - RIP Oppo

> CB

Dr. Zoidberg - RIP Oppo

> CB

10/14/2019 at 20:09 |

|

Iíll take the $100,000 and they donít even have to let me in the city. Win-win

VajazzleMcDildertits - read carefully, respond politely

> Dr. Zoidberg - RIP Oppo

VajazzleMcDildertits - read carefully, respond politely

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 20:10 |

|

Oh that makes more sense, I couldnít figure out how disposable income was working. I donít want to click on a slideshow, but I might have to just for more info.†

facw

> Dr. Zoidberg - RIP Oppo

facw

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 20:12 |

|

You can definitely live on $100,000 with $2,200 rent, especially if you donít have bad outstanding debts, so I agree with your analysis. Even on with way more rent it should still be doable.

One big thing you are missing is health insurance (and possibly health care costs, though those will vary much like student debt).

FWIW, I lived in a $3,200/month apartment on a salary that wasnít much over $100k, without any financial difficulties, though I probably wasnít saving quite as much as I should. I certainly wasnít living paycheck to paycheck though.

Dr. Zoidberg - RIP Oppo

> just-a-scratch

Dr. Zoidberg - RIP Oppo

> just-a-scratch

10/14/2019 at 20:13 |

|

Youíre right, disposable should strictly mean income minus taxes/SS/etc, and not ďleftover after all taxes and bills and some food.Ē

You think itís as low as 24%? Iím pretty sure my paystub shows...

[furiously types on calculator]

... well Iíll be dipped, almost exactly 23%. But I have other deductions, like my share of healthcare, IRA, HSA...

Highlander-Datsuns are Forever

> Dr. Zoidberg - RIP Oppo

Highlander-Datsuns are Forever

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 20:15 |

|

I think your math is solid but most folks spend north of $ 500-1000/ month on entertainment, clothing, and out to eat.

RPM esq.

> Dr. Zoidberg - RIP Oppo

RPM esq.

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 20:16 |

|

No, youíre right, that estimate is insane. $100k and $2.2k in rent would be a perfectly comfortable living in Seattle. Source: I live in Seattle and must be a financial genius since I havenít gone broke yet. Come to think of it, neither has anyone I know, even on substantially less than $100k.

Your math is even too kind, I think. The effective tax rate on $100k is like 15%. This person starts with $85k after income tax, and then has the other stuff, so, conservatively, $75k. Also, non-car transportation is easy to quantify: an unlimited non-subsidized ORCA card is $90 per month, and most larger employers subsidize them. So the maximum possible yearly public transportation cost is $1080, and most people making $100k donít even pay that much. Conservatively, after the basic monthly expenses, this person has over $30k annually to spend on non-grocery essentials (clothes, basic personal care, etc.) and non-essentials (gifts, entertainment, travel, their vices of choice), a car, and/or to service debts or save.

ETA: fixed some math. Point still stands.

Dr. Zoidberg - RIP Oppo

> Highlander-Datsuns are Forever

Dr. Zoidberg - RIP Oppo

> Highlander-Datsuns are Forever

10/14/2019 at 20:16 |

|

Dang, I need to be friends with these folks, so they can spend of that on me

dtg11 - is probably on an adventure with Clifford

> Dr. Zoidberg - RIP Oppo

dtg11 - is probably on an adventure with Clifford

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 20:20 |

|

I think the differences in rent across the country is wild. Here in Missouri, Iíll be renting a 3-bedroom, 2 bath, 1200 SQ FT apartment for $615/month, water and trash included. How much would something like that be in Seattle? Or do I even want to know?

Dr. Zoidberg - RIP Oppo

> RPM esq.

Dr. Zoidberg - RIP Oppo

> RPM esq.

10/14/2019 at 20:21 |

|

I mean, shit: you can meet another young working single who makes even half as much, next thing you know youíve got $150,000 combined income, split all the bills and rent, eat a little more food, and suddenly youíve gone from ďcomfortableĒ to downright ďcozy.Ē

RPM esq.

> Highlander-Datsuns are Forever

RPM esq.

> Highlander-Datsuns are Forever

10/14/2019 at 20:22 |

|

A person who spends $1000 per month on entertainment, clothing, and going out to eat would still have another $1 000+ per month to spend on...other stuff in this scenario.

Dr. Zoidberg - RIP Oppo

> dtg11 - is probably on an adventure with Clifford

Dr. Zoidberg - RIP Oppo

> dtg11 - is probably on an adventure with Clifford

10/14/2019 at 20:22 |

|

It would be about 1-billion times more expensive.

RPM esq.

> jimz

RPM esq.

> jimz

10/14/2019 at 20:22 |

|

So you didnít read the post at all, then?

RPM esq.

> MM54

RPM esq.

> MM54

10/14/2019 at 20:23 |

|

Not even close. Uncle Sam takes, like, 25% at most.

Dr. Zoidberg - RIP Oppo

> facw

Dr. Zoidberg - RIP Oppo

> facw

10/14/2019 at 20:25 |

|

I kind of ďattemptedĒ to build that in. I keep less than 70% percent of my paycheck because my healthcare burden is deducted on top of my taxes, SS, etc. I also have an IRA and HSA, so that getís the number down more. In other words, I feel that 30k out of 100k generally covers federal income taxes, SS taxes, medicare, and deductions due to employee benefits. Maybe.

RPM esq.

> Dr. Zoidberg - RIP Oppo

RPM esq.

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 20:26 |

|

I highly recommend this course of action. Hell, at that point you could move into one of those fancy $3k units, have a kid, and think seriously about private school.

Dr. Zoidberg - RIP Oppo

> RPM esq.

Dr. Zoidberg - RIP Oppo

> RPM esq.

10/14/2019 at 20:27 |

|

Great, but first I need to divorce my wife and lose most of my money before I meet that young working single. Or, I guess after. The end result will be the same.

RPM esq.

> dtg11 - is probably on an adventure with Clifford

RPM esq.

> dtg11 - is probably on an adventure with Clifford

10/14/2019 at 20:30 |

|

Depends on how nice a view you want, but if youíre actually in the city and in a desirable neighborhood, Zillow tells me easily $2500-3200. More like $2000 in the close-in suburbs.

dtg11 - is probably on an adventure with Clifford

> Dr. Zoidberg - RIP Oppo

dtg11 - is probably on an adventure with Clifford

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 20:30 |

|

From everything Iíve seen about the PNW, I believe it. Iíd never want to live there

RPM esq.

> For Sweden

RPM esq.

> For Sweden

10/14/2019 at 20:32 |

|

Thatís about what it would take to make the math in the article work. That, or one mother of a gambling addiction .

dtg11 - is probably on an adventure with Clifford

> RPM esq.

dtg11 - is probably on an adventure with Clifford

> RPM esq.

10/14/2019 at 20:33 |

|

thatís absolutely insane, I canít imagine ever being able to afford that

Dr. Zoidberg - RIP Oppo

> dtg11 - is probably on an adventure with Clifford

Dr. Zoidberg - RIP Oppo

> dtg11 - is probably on an adventure with Clifford

10/14/2019 at 20:35 |

|

Hereís a meaningless anecdote: thereís a house six blocks from me, 3 beds 1 bath, unupdated, but water view... Asking rent? $2,495.00

Needless to say, it remains vacant.

RallyWrench

> Dr. Zoidberg - RIP Oppo

RallyWrench

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 20:37 |

|

The only thing I donít see on your list of overhead that may cost a fair chunk of money is health insurance , but even so, their math seems suspect . I would kill to have $2,300 left over every month . Itís more like $23.00, if Iím lucky.†

RallyWrench

> facw

RallyWrench

> facw

10/14/2019 at 20:42 |

|

Health insurance was also my first thought on additional expenses , because t hat robs me of $650 every month. N ot small change.

gmporschenut also a fan of hondas

> Dr. Zoidberg - RIP Oppo

gmporschenut also a fan of hondas

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 20:43 |

|

This is like that dumb article of the manhatten couple ďscraping by) on 500k and then you see they spend 20k a year on vacations, 18k on food,17k for 2 cars in manhatten etc.

After college I worked in the suburb of a large city. Most of my young coworkers lived in the city. I had lived in it and did the reverse commute and kept thinking, of returning. B ut what deterred me the most wastnít so much the cost of housing +20-30%. It was the cost to commute (tolls, gas, wear and tear, depreciation ) + in many areas parking costs. I still recal all the folks going on how broke they were and thinking ďwe all make the same amountĒ. Then i hear how they go out to dinner 5 nights a week etc. (kinda why I wanted to move back, but remembered how much that can add up) †

RallyWrench

> dtg11 - is probably on an adventure with Clifford

RallyWrench

> dtg11 - is probably on an adventure with Clifford

10/14/2019 at 20:44 |

|

Amazing. Anything 3/2 would be a bare minimum of $2,000 here (CA) .††

glemon

> Dr. Zoidberg - RIP Oppo

glemon

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 20:44 |

|

I think they probably take home less than that if they have health insurance and a match they put in on a 401k, but still probably somewhere between $60,000 and $70,000 take home, but still, I † would think a single apartment dweller could swing it

RallyWrench

> CB

RallyWrench

> CB

10/14/2019 at 20:45 |

|

Cars. Weíre blowing it on cars.†

wkiernan

> MM54

wkiernan

> MM54

10/14/2019 at 21:02 |

|

The state of Washington does not have a state income tax. I

n

t

h

e

worst case, a

t

l

a

s

t

y

e

a

r

í

s

Federal income tax rates, if you earne

d

$100,000 and

e

v

e

r

y

l

a

s

t

c

e

n

t

o

f

i

t

w

e

r

e

fully taxable - not only do you c

l

a

i

m

no dependents but you donít even take the personal deduction for yourself! - youíd

pay $1

8,

2

8

9

.

5

0

in income tax ($9,5

2

5

at 10% plus $29

,

1

75 at 12

% plus $4

3

.

8

00 at 22

% plus $1

7

,

5

0

0

at 24

%). Y

ou must a

l

s

o

pay t

a

x

e

s

f

o

r

So

c

i

a

l

Se

c

u

r

i

t

y

a

n

d

Medicare. If you worked in a regular job, youíd pay 7.65%

o

f

y

o

u

r

ď

i

n

c

o

m

e

Ē

(

l

i

n

es 3 and 5 on your W-2)

and your employer would pay 7.65%. But if you are self-employed (an odd contractor with zero deductible business expenses) youíd pay the full

12.4% SS plus 2.9% Medicare over the whole $100K making

$15,300, which added to $1

8

,

2

8

9

.

5

0

totals

t

o

$33

,

5

8

9

.

5

0

, which I, as an arithmetic crank, feel obliged to point out is a bit shy of $45K.

A

n

d, of course, no one claims zero dependents and zero deductions, a

n

d

m

o

s

t

p

e

o

p

l

e

o

n

l

y

p

a

y

t

h

e

e

m

p

l

o

y

e

e

í

s half of the SS/Medic

are

t

a

x

, so

a

n

y

b

o

d

y

í

s

a

c

t

u

a

l

t

a

x

b

i

l

l

w

i

l

l

b

e

l

e

s

s

.

J u s t f o r l a u g h s (y e a h this is my idea of ď l a u g h s Ē ) I g o g g l e d u p ď i n f l a t i o n c a l c u l a t o r Ē a n d g o t t o †

w h i c h s a y s t h e i n f l a t i o n - a d j u s t e d e q u i v a l e n t o f $ 1 0 0 , 0 0 0 today w a s $ 5 9 , 4 0 0 i n 1 9 9 5 . Using the same a b s u r d w o r s t - c a s e ( i . e . z e r o - d e d u c t i o n) m o d e l f o r i n c o m e t a x l i a b i l i t y and the 1 9 9 5 F e d e r a l rates I c a m e u p w i t h a i n c o m e t a x b i l l o f $ 1 3 , 6 8 2 p l u s 1 5 . 3 % S S / M e d i c a r e o n $ 5 9 , 4 0 0 = $9088.20 f o r a g r a n d t o t a l o f $ 2 2 , 7 7 0 . 2 0 , o r 3 8 . 3 3 %.

CTSenVy

> Dr. Zoidberg - RIP Oppo

CTSenVy

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 21:05 |

|

Either I live in the complete boondocks or I live way below the poverty line and don't know it.††

VajazzleMcDildertits - read carefully, respond politely

> Dr. Zoidberg - RIP Oppo

VajazzleMcDildertits - read carefully, respond politely

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 21:07 |

|

The average tends to hide outliers. Iíd rather see the median rent, which statesticly tends to reflect a commonality a little better than the mean.

This shows median rent in June to be $2259, so Iíll split the difference and say 2250 for easy maths. Iím also using this a bit. https://smartasset.com/mortgage/what-is-the-cost-of-living-in-seattle

Iím using this calculator for take home pay . At 100k a year, you should be saving for retirement in the 401k at employ, but substitute your IRA if thatís what youíre using instead. Pre-tax, obviously. If you make 100k a year and you donít save for retirement, youíre being extremely foolish no matter how old you are.

I punched in 100 per paycheck for medical, 10% 401k withholding (people who have extra money should be doing 15%), 20 for dental and 20 for vision. A lot of big companies will comp you if you have no family members, so you could fiddle with it and say medical insurance costs nothing, but I canít guarantee that.

Your take home is 2746 per semi-monthly paycheck. 2 paychecks a month, 12 months a year. Thatís 65,904 annually, 5492 a month. Should be a piece of cake. Speaking of cake, I would expect food costs to be double what it is outside of town. Everything costs more in the city, and also, when you make 100k you donít always wind up eating Ramen noodles or cheap groceries. Your friends probably make similar amounts considering where you live. Iíve seen food bills per month that would probably make you shit your pants.

Median student debt in the US is between 10k and 25k per Wikipedia (average is 38k!), so letís say itís 15k. I got charged just shy of 5% for mine, over 10 years, which is a $159 monthly payment. Other loans will probably be way worse than this. I also expect Utilities to be more than $400 but I can see that thatís probably reasonable if youíre frugal.

If you do own a car (i bet this example of theirs does) the fees are ridiculous for in city living. You typically pay for parking, which is variable, but letís say itís $200 a month. The car payment. Assuming itís a recent used car, letís say $200 a month. Insurance will probably be shit especially if you are under 25. Letís say $200 a month. Maintenance and fuel will be at least another $200 a month, since there is probably nowhere in your apartment to work on your own car without getting into trouble.

I note from one of the links above that an Orca card (their bus pass or w/e) is around $100, so you could swap that out.

I find that misc expenses (random things that need replacing, bad news, etc) will probably need about $200/month.

Donít forget, the sales tax in Seattle is 10.10%. Only offset is that Washington doesnít seem to have a state income tax?

Rent (I find this low price implausible tbh): 5492 - 2250 = 3242 / month

Food (2.5x your estimate 1000

/ month): 1

992 / month

Utilities 400 = 1

992 - 400 = 1

592 / month

Student Loans = 1

592 - 159 = 1

433 / month

Car = 1

433 - 800 =

633/month

misc =

633 - 200 =

433/month

About $108.25

†a week to handle random shit or to spend money on. Stocking away all that on a rainy day is probably good for you, which is why single people tend to be richer. Keep in mind if you have a wife to needs your benefits or if you have a couple of kids in tow, all these costs start spiking significantly. Iíd say budget AT LEAST $1000/mo for just about anyone else who depends on you in the least. 2-3 kids and youíre easily in the red, Child tax deduction or no.

Also, that slideshow is fucking useless.

Dr. Zoidberg - RIP Oppo

> VajazzleMcDildertits - read carefully, respond politely

Dr. Zoidberg - RIP Oppo

> VajazzleMcDildertits - read carefully, respond politely

10/14/2019 at 21:11 |

|

My food estimate was actually 100/week or 400/month

All that said, even with you adding in student loans and a car, you still donít even up with negative 24k annua lly as the article suggests. No oneís even gotten close.

VajazzleMcDildertits - read carefully, respond politely

> Dr. Zoidberg - RIP Oppo

VajazzleMcDildertits - read carefully, respond politely

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 21:14 |

|

Sorry, first edition, I hit enter too early and pasted in half of it. I can edit it for the grocery bills.

However, the slideshow doesnít indicate whether thereís a family or not. But I bet heís using a pessimistic scale either way. Let me fix what I got.

Edit: My conjecture is that he is probably factoring significantly higher rent, like $4000 or something. I know that pulling in all the extra insurance benefits I can leverage (term life, extra AD&D, weird other rand om stuff) can pull in another $150 a paycheck, Gas is at least $3.60 a gallon it seems and with the bad traffic youíll be burning an extra 2-3 gallons a trip just idling. And mortgages, once you factor in taxes and insurance are higher than just the principal + interest payment, and probably food costs are higher than we think.

Leave the car in and youíd probably at a net loss of about a grand a month , since I used averages and medians where I could. I wouldnít be surprised if some early mid- level IT tech bro who makes around that salary to have running costs of 5K a month unless he didnít want a car.

There are a lot of alcoholics in that industry.†

Svend

> Dr. Zoidberg - RIP Oppo

Svend

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 21:16 |

|

Oh my God. Youíve made my week.

With you as an American saying maths and not just math, youíve made my week.

Thank you.

Itís one of those American things that really bug me like,

ĎI need to speak to you real quickí, no speak to me at a regular tempo so I can understand.

Or

ĎI reached out for a comment', no you didn't, you used a contact number/address/e-mail/etc... and contacted them.†

NKato

> Dr. Zoidberg - RIP Oppo

NKato

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 21:18 |

|

†The problem is that landlords don't try to get renters ASAP. If it's still vacant after a quarter, it's likely owned by foreigners.†

VajazzleMcDildertits - read carefully, respond politely

> VajazzleMcDildertits - read carefully, respond politely

VajazzleMcDildertits - read carefully, respond politely

> VajazzleMcDildertits - read carefully, respond politely

10/14/2019 at 21:27 |

|

I would like to point out I seem to have invisibly subrac ted $250 too much to the food deduction but it wonít let me edit any longer. Sorry about that.

AestheticsInMotion

> RPM esq.

AestheticsInMotion

> RPM esq.

10/14/2019 at 22:06 |

|

Have you looked at Redmond lately? Itís eclipsed Kirkland and B ellevue, significantly too. Weíre at the 1 bedroom/1 bath for $2.5-3k point, at least downtown. Craziness†

Dr. Zoidberg - RIP Oppo

> CTSenVy

Dr. Zoidberg - RIP Oppo

> CTSenVy

10/14/2019 at 22:40 |

|

Youíre doing just fine. Just donít move here.

subexpression

> Dr. Zoidberg - RIP Oppo

subexpression

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 22:41 |

|

Lots of people are bad with money. L ots of other people in recent years have been finding ways to cash in by telling them itís not their fault that theyíre broke . Itís a lot easier to sell that idea than it is to help people get/stay out of trouble .

Highlander-Datsuns are Forever

> RPM esq.

Highlander-Datsuns are Forever

> RPM esq.

10/14/2019 at 22:51 |

|

Then they need to factor in about seven subscriptions for streaming video.

wafflesnfalafel

> Dr. Zoidberg - RIP Oppo

wafflesnfalafel

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 23:36 |

|

yes, but I spend $78 00 on hipster beard oil annually

farscythe - makin da cawfee!

> Dr. Zoidberg - RIP Oppo

farscythe - makin da cawfee!

> Dr. Zoidberg - RIP Oppo

10/14/2019 at 23:49 |

|

70 grand disposable?

O.o

thats twice what i make a year.......that said... my rent is 650 a month for a 3 bedroom house

i takes a ridiculous amount of money to be poor over there

LastFirstMI is my name

> Dr. Zoidberg - RIP Oppo

LastFirstMI is my name

> Dr. Zoidberg - RIP Oppo

10/15/2019 at 01:07 |

|

Probably written by some dude who is trying to convince his parents to give him more money. Or explain to his girlfriend why they canít get married. Maybe both.†

RPM esq.

> dtg11 - is probably on an adventure with Clifford

RPM esq.

> dtg11 - is probably on an adventure with Clifford

10/15/2019 at 13:21 |

|

Well, depending on your industry you might make 40% more to do the same job here, if that makes it easier to imagine. Not true of every industry of course, but salaries are generally higher here than in places where rent is 50 cents per square foot.

Snuze: Needs another Swede

> Dr. Zoidberg - RIP Oppo

Snuze: Needs another Swede

> Dr. Zoidberg - RIP Oppo

10/15/2019 at 13:42 |

|

At one point Mrs. Snuze and I were living on well under $100k. We had a 1 bedroom apartment in one of the wealthiest areas of Northern VA - itís not Seattle but I bet itís not significantly cheaper either . We had health insurance, both had cars and associated expenses (I was still paying off the Snuze, too ), she was putting money into retirement savings, and all the other normal living expenses . W e had smart phones, cable internet, ate out at decent resturaunts a couple times a week and were still able to do s tuff we wanted to, go shopping , etc. I mean we werenít lighting our cigars with $100 bills either, but it wasnít bad. The only thing I can think of significantly different than most peoples situations was we have zero student loan debt.††